Why is Diversification Important?

Diversification is like having a financial safety net. It spreads your investments across different asset types, reducing the impact of a single investment’s poor performance. This helps protect your wealth and can lead to more consistent long-term returns.

- David Adebomi

- |

- 06:02

- Hours Ago

Water is the lifeblood of our planet, crucial to the survival of ecosystems and human

Latest Articles

- 06

- Hours Ago

- 11

- Hours Ago

FAQ

We present our readers with timely market updates and up-to-date news on the financial climate around. This will enable them to have immediate insights and give them space to act on their portfolio immediately.

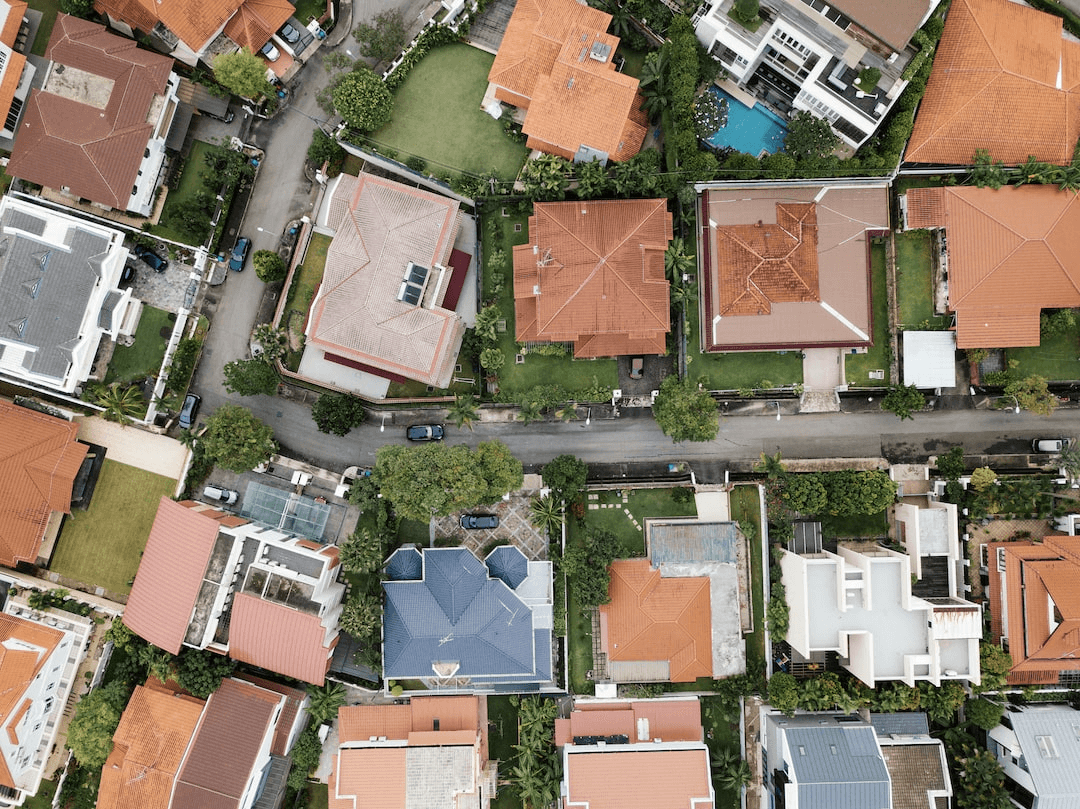

Great question! Begin by considering different asset classes like stocks, bonds, real estate, and even alternative investments. Allocate your funds among them based on your financial goals and risk tolerance. It’s like creating a recipe for financial success, blending different ingredients for the best flavor.

There’s no one-size-fits-all answer, as it depends on your individual goals and comfort level with risk. Generally, though, a balanced mix of stocks, bonds, and cash can provide a solid foundation. You might adjust this mix over time as your goals evolve. Fall back on our website for more timely updates on market insights and investments.

Absolutely! Investing internationally can add an extra layer of diversification. Different countries and regions may have different economic cycles, and this can help balance your portfolio’s performance. Think of it as expanding your investment passport.

Regular check-ins are crucial. Market fluctuations can shift your portfolio’s balance over time. Aim to review it annually or when significant life events occur, like getting married, having children, or nearing retirement. Think of it as giving your portfolio a health checkup to ensure it’s still aligned with your goals. Simply keep an eye on this website for more inputs that you cannot miss!