Introduction

When it comes to financing your travels, the right credit card can be your passport to saving significantly on your adventures. Travel credit cards offer a spectrum of benefits, from accumulating points towards flights and accommodations to enjoying elite status perks and comprehensive travel insurance. Understanding how to leverage these rewards can transform your travel expenses, turning every dollar spent into a step closer to your next destination. This guide aims to navigate the intricacies of travel credit cards, helping you choose the most suitable one, maximize your rewards, and ultimately save money on your journeys.

KEY TAKEAWAYS

- Benefits of Travel Credit Cards: Travel credit cards offer rewards like points and miles for travel expenses, along with perks such as lounge access and travel insurance, saving money and enhancing the travel experience.

- Choosing the Best Travel Credit Card: Consider travel habits and goals, compare fees and rewards programs, and research redemption options to find the best card.

- Strategies to Maximize Rewards: Take advantage of sign-up bonuses, concentrate spending on bonus categories, and utilize card-specific portals and partnerships. Use rewards for travel savings through booking portals, transferring points, and taking advantage of discounts.

Benefits of Travel Credit Cards

Earn and accumulate rewards.

Travel credit cards are designed to reward cardholders for their spending by offering points or miles that can be redeemed for travel expenses, such as flights and hotel stays. Many cards offer signup bonuses that can jumpstart your rewards balance, and some cards provide extra points for spending in specific categories like dining or travel.

Travel perks and benefits

Aside from gathering points, travel credit cards often come with added benefits that enhance your travel experience. These perks can include complimentary airport lounge access, travel insurance, no foreign transaction fees, and free checked bags. Such benefits not only make traveling more enjoyable but can also save you money.

How to Choose the Best Travel Credit Card

Consider your travel goals and preferences.

Your choice of a travel credit card should align with your travel habits and goals. Determine whether you prefer a card that earns hotel stays, airline miles, or flexible rewards that can be used for various travel expenses.

Compare annual fees, interest rates, and foreign transaction fees.

It’s crucial to weigh the costs of a travel credit card against its benefits. Look for a card with an annual fee that you can justify through its rewards and benefits. Also, consider the card’s interest rates and whether it charges foreign transaction fees, which can add up during international travel.

Research rewards programmes and flexibility

Evaluate how easy it is to earn and redeem rewards with different credit cards. Some cards might offer higher rewards rates or more flexible redemption options than others. Ensure the rewards programme aligns with your travel plans and offers good value for the points or miles you’ll accumulate.

Strategies to Maximize Travel Credit Card Rewards

Take advantage of sign-up bonuses.

One of the quickest ways to accumulate points or miles with a travel credit card is by taking advantage of sign-up bonuses. These bonuses often require you to spend a certain amount on purchases within the first few months of opening your account. By strategically planning your purchases to meet these requirements, you can earn a significant reward boost.

Optimize spending to maximize rewards.

Identify categories in which your card offers increased rewards, such as dining, travel, or groceries. By concentrating your spending on these categories, you can accumulate rewards more rapidly. Some cards offer rotating categories with higher rewards, so keeping track of these changes can further optimize your benefits.

Utilize card-specific rewards portals and partnerships.

Many travel credit cards have associated rewards portals and partnerships with hotels, airlines, and retailers. Purchasing through these portals or using affiliated services can yield higher reward rates or exclusive deals, enhancing the value of every dollar spent.

Tips for Using a Travel Credit Card Abroad

Check for international acceptance and chip-and-pin capability.

Before traveling, ensure your card is widely accepted in your destination country. Cards with chip-and-pin technology offer greater convenience and security at international payment terminals and ATMs.

Notify the issuer about your travel plans.

Informing your card issuer about your travel itinerary can prevent your account from being flagged for suspicious activity. This step is crucial for uninterrupted card use while abroad.

Be aware of potential foreign transaction fees.

Review your card’s terms to understand any foreign transaction fees that may apply to overseas purchases. Choosing a card with no foreign transaction fees can save a significant amount in costs, making it a better option for frequent international travelers.

Additional Travel Credit Card Features to Consider

Travel insurance and protection

Many travel credit cards offer various types of insurance, including trip cancellation, baggage loss, and rental car insurance, providing a safety net that can save you from unexpected expenses during your travels.

Lounge access and airport perks

Some premium travel credit cards offer complimentary access to airport lounges, priority boarding, and other perks that can make your overall travel experience more comfortable and less stressful.

There are no blackout dates or restrictions.

A significant advantage of certain travel credit cards is the flexibility they offer, such as no blackout dates or booking restrictions, which means more freedom in planning your trips according to your schedule.

How to Use Travel Credit Card Rewards for Travel Savings

Booking through the issuer’s travel portal

Often, you can get additional value by booking travel directly through your credit card issuer’s travel portal, benefiting from exclusive deals or increased rewards.

Transferring points to travel partners

Transferring your earned points or miles to airline or hotel partners can significantly increase their value, especially if you can take advantage of a partner’s reward programme.

Taking advantage of discounted flights and hotel stays

Keep an eye out for opportunities where your travel credit card offers discounts or special deals on flights and hotel stays. These can lead to substantial savings, stretching your rewards even further.

Common Pitfalls and Mistakes to Avoid

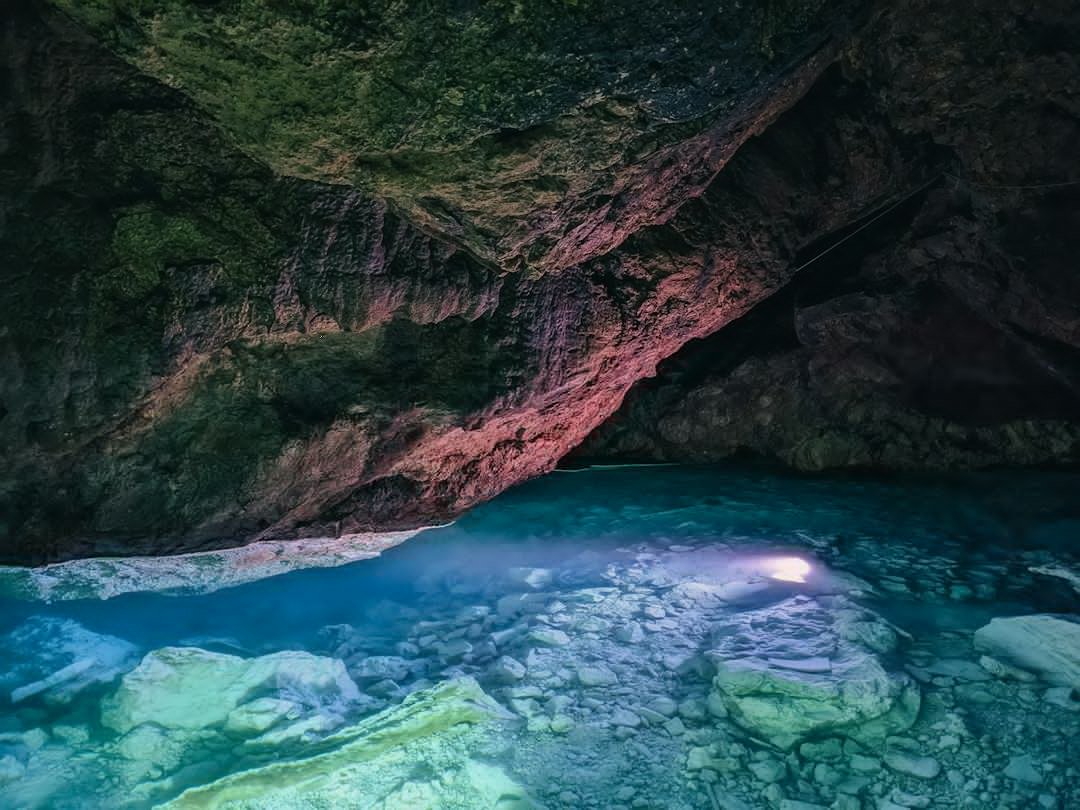

Image courtesy: Unsplash

Carrying a high balance and paying interest

A significant error is maintaining a high balance on your travel credit card, thereby incurring high interest. This can negate any rewards earned, making your card cost more than the benefits it provides.

Overspending to earn rewards

To maximize rewards, some cardholders spend more than they can afford, leading to potential debt. It’s crucial to only charge what you can comfortably pay off each month to truly benefit from any rewards.

Neglecting to read the fine print and understand the terms

Many users fail to thoroughly review their credit card’s terms and conditions, missing out on critical details like blackout dates or restrictions. This oversight can limit the usefulness and enjoyment of earned rewards.

Conclusion

Choosing the right travel credit card can transform your travel experience, offering significant savings and luxurious benefits. By understanding the rewards structure, assessing annual fees against benefits, and utilizing card perks effectively, travelers can maximize their savings and enhance their travel experiences. Remember, the best travel credit card is one that aligns with your travel habits and financial goals. With careful consideration and strategic use, a travel credit card can become a powerful tool in your travel arsenal, paving the way for smarter, more rewarding adventures.